In the complex realm of forex trading, the AB=CD Trading Pattern stands out as a crucial tool. It harmonises price movements, offering a reliable framework for traders of all levels. The AB=CD Trading Pattern is a cornerstone in predicting market shifts. I will introduce you to its basics, laying a solid groundwork before exploring its advanced aspects.

Exploring the Forex AB=CD Pattern is akin to solving a financial puzzle. Each movement and retracement uncovers a piece of the larger picture, guiding traders towards lucrative opportunities. This pattern is fundamental in both forex and stock markets, serving as a cornerstone of technical analysis. For a deeper understanding, consider resources like the 5-0 trading pattern for intraday stock, which complements your grasp of chart analyses and technical indicators.

Key Takeaways

- The AB=CD Trading Pattern is a harmonic price structure used to predict market movements.

- Mastering this pattern can significantly enhance your trading strategies.

- Understanding its core elements is crucial for accurate market predictions.

- The pattern applies to both forex and stock markets.

- Technical analysis tools can help in optimally identifying and utilising the AB=CD Pattern.

Introduction to the AB=CD Trading Pattern

The AB=CD Pattern is a fundamental tool in technical analysis, crucial for Forex traders. It offers deep insights into market trends and predictive capabilities. These can lead to profitable trading opportunities.

What is the AB=CD Pattern?

The AB=CD Pattern is built on four key segments: XA, AB, BC, and CD. Each part is vital for spotting market reversal points. Traders use the pattern’s symmetry and proportion to verify its authenticity.

The AB leg marks the initial move, followed by a corrective phase in the BC leg. The CD leg completes the pattern, mirroring the AB leg in both price and time. This mirror-like structure is what makes the AB=CD Pattern so effective in predicting market trends.

Importance in Forex Trading

The AB=CD Pattern’s role in Forex trading is immense. Its predictive nature helps traders foresee market reversals. This allows for the execution of strategies based on these insights. The AB=CD Trading method helps pinpoint entry and exit points, improving trading outcomes.

The Trading AB=CD Strategy is popular for its simplicity and effectiveness. By grasping how this pattern works, traders can better navigate the Forex market. This leads to more informed trading decisions.

Mastering the AB=CD Trading technique gives traders a powerful tool for market analysis. It significantly boosts their trading performance.

The History and Evolution of the AB=CD Pattern

The History of AB=CD Pattern traces back to early technical analysis. It has a long-standing reputation for reliability among traders. This solid foundation has made it a staple in various financial markets over time.

The Evolution of AB=CD Trading began with the work of early financial analysts. The AB=CD pattern’s essence was first seen in stock price movements. It gained popularity through a systematic trading approach.

Early supporters have given invaluable insights, refining the AB=CD pattern. The pattern’s mathematical basis, including Fibonacci levels, is key to its reliability and predictive strength.

The AB=CD pattern is not merely a static formation but an evolving paradigm that adapts to the shifting dynamics of trading environments.

Through the ages, the pattern has proven its worth in stock markets and beyond. It has expanded into commodities, futures, and forex trading. This versatility is at the heart of the Evolution of AB=CD Trading, making it a valuable tool for today’s traders.

- Early Adoption: Initially applied to stock market analysis.

- Mathematical Refinement: Integration of Fibonacci ratios.

- Expansion into Other Markets: Commodities, futures, and forex trading.

The narrative of the History of AB=CD Pattern and its evolution highlights its lasting importance. It shows that even foundational ideas can adapt to modern trading needs while retaining their core value.

Understanding the Core Elements of the AB=CD Pattern

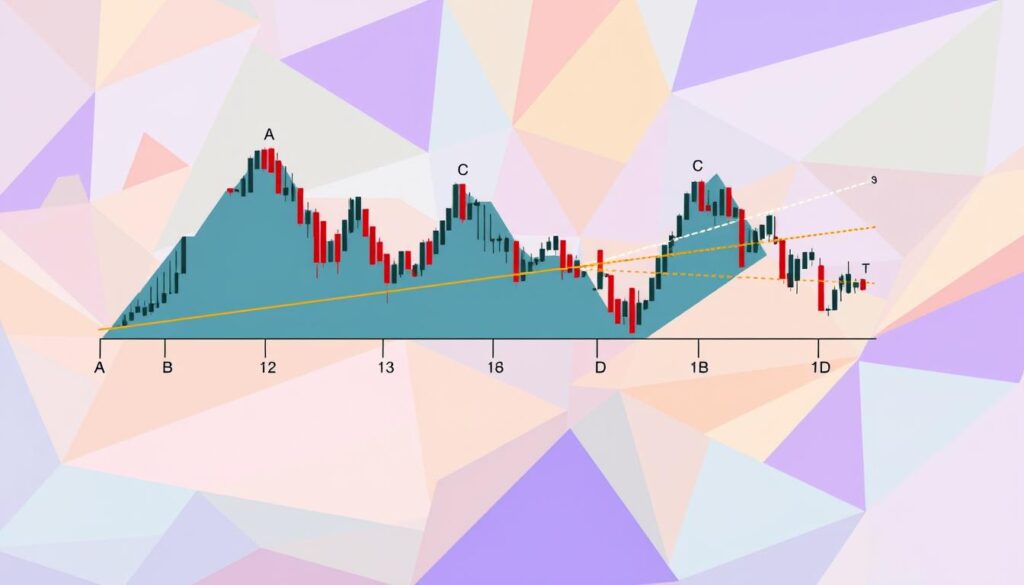

To fully grasp the AB=CD pattern, it’s essential to understand its core elements. The pattern consists of three legs: AB, BC, and CD. Each leg is crucial for the pattern’s formation and validation through technical analysis and price structure. Here’s a detailed look at each leg.

AB Leg: The Initial Move

The AB leg marks the beginning of the AB=CD pattern. It’s a strong price movement in one direction, laying the groundwork for the next legs. Technical analysis often focuses on this leg to forecast future price movements. The AB leg’s significance lies in establishing a baseline for traders to start their strategies.

BC Retracement: Corrective Phase

The BC leg follows the AB leg, acting as a corrective phase. Here, the price retraces part of the initial move, typically between 38.2% and 61.8% of the AB leg. This aligns with Fibonacci ratios. The AB-CD Price Structure aids in pinpointing the ideal retracement length, making this phase key for confirming the pattern’s symmetry.

CD Leg: Completion Phase

The CD leg is the pattern’s final phase. It mirrors the AB leg in length and duration, highlighting the pattern’s symmetrical nature. Technical analysis is crucial here, as traders seek the CD leg to match the AB leg’s distance. This validation signals potential trade opportunities.

AB=CD Trading Pattern in Forex

The Forex AB=CD Pattern is a crucial tool for traders in the fast-paced world of currency pairs. It offers a structured way to grasp market movements and forecast price shifts. We’ll delve into how this pattern applies to various currency pairs and strategies for spotting it on Forex charts.

Application in Currency Pairs

To apply the Forex AB=CD Pattern across different currency pairs, a thorough understanding of each pair’s unique traits is essential. This pattern shines in high-volatility pairs like EUR/USD or GBP/JPY, where significant price movements create substantial trading chances. To make the most of the Forex AB=CD Pattern, grasping the risk and reward of each currency pair is vital.

Identifying AB=CD in Forex Charts

Spotting AB=CD patterns in Forex charts requires identifying specific price movements that fit the pattern’s structure. Here are some essential tips for identifying AB=CD patterns accurately:

- Ensure the AB and CD legs are of approximately equal length.

- Look for a clear retracement in the BC leg, typically falling between 61.8% to 78.6% Fibonacci levels.

- Use confirmation tools like oscillators or moving averages to validate the pattern.

By adhering to these guidelines, traders can enhance their skill in distinguishing real formations from false signals. This improvement will bolster their trading strategy.

The Role of AB=CD in Harmonic Trading

In the vast realm of harmonic trading, the Harmonic AB=CD Pattern stands out. It’s crucial for spotting market reversals and planning strategies based on future price movements. The Harmonic Trading AB-CD Pattern is key for traders aiming for precise market entries and exits.

Traders use the Harmonic AB=CD Pattern in their harmonic trading toolkit for its predictive strength. Unlike random patterns, it follows strict mathematical and geometrical rules. This makes it a reliable part of harmonic trading strategies.

Recognising the harmonic AB=CD pattern in trading gives traders a forward-looking analysis tool. It helps them forecast price movements, not just react to them.

The following overview compares the Harmonic AB=CD Pattern with other harmonic patterns:

| Pattern | Geometric Configuration | Application |

|---|---|---|

| AB=CD | 1.0 AB = 1.0 CD | Predicts potential reversals, confirming entry and exit points. |

| Gartley | AB=0.618 XA, BC=0.382-0.886 AB | Identifies buy or sell opportunities at specific retracement levels. |

| Bat | AB=0.382-0.5 XA, BC=0.382-0.886 AB | Used for precision in trading by marking exact price levels. |

| Butterfly | AB=0.786 XA, BC=0.382-0.886 AB | Seeks reversal points at extreme highs and lows. |

The table shows the Harmonic Trading AB-CD Pattern’s preference for its symmetry and reliability. It consistently meets the criteria for successful harmonic trading, making it highly accurate in predictions.

AB=CD Pattern Formation and Identification

The AB=CD Pattern Formation is crucial in trading, often indicating high-probability setups. It relies on the symmetry of its four points: A, B, C, and D. To confirm an AB=CD Pattern Formation, certain criteria must be met. This ensures traders use the most reliable patterns.

- The AB and CD legs should be roughly equal in length.

- The retracement from B to C should be between 61.8% and 78.6% of the AB leg.

- The CD leg should mirror the AB leg in both magnitude and duration for an ideal pattern.

- Identify the initial AB leg during a trend.

- Monitor the BC retracement for specific Fibonacci levels.

- Await the completion of the CD leg to confirm the pattern.

When using the Trading AB=CD Strategy, I scrutinise these criteria to distinguish between strong and weak patterns. Real-time chart analysis enhances detection precision.

Understanding the subtle variations in retracement levels and projection lengths can significantly improve the accuracy of identifying the AB=CD pattern in live trading scenarios.

| Criteria | High-Probability Setup | Weak Setup |

|---|---|---|

| Leg length symmetry | AB = CD | AB ≠ CD |

| Retracement levels | 61.8% – 78.6% | Below 61.8% or Above 78.6% |

| Projection accuracy | Highly accurate | Inconsistent |

With these guidelines, identifying the AB=CD pattern becomes straightforward. This leads to more informed trading decisions. By understanding the AB=CD Pattern Formation and applying the Trading AB=CD Strategy, traders can gain better control over their trading activities.

Technical Analysis with the AB=CD Pattern

Exploring AB=CD Technical Analysis reveals a mix of precision and strategic forecasting. It’s crucial to understand how to use Fibonacci ratios and technical indicators. This knowledge can greatly improve trading results.

Using Fibonacci Ratios

Fibonacci Ratios play a key role in AB-CD analysis, helping predict potential reversal points. By identifying these ratios, traders can find the best times to enter and exit the market. The 0.618 and 1.618 Fibonacci levels are particularly useful for gauging market sentiment and anticipating price movements.

Below is a table that outlines the essential Fibonacci Ratios in AB-CD:

| Fibonacci Ratio | Application |

|---|---|

| 0.618 | Retracement level often seen in the AB leg |

| 1.618 | Extension level typically observed in the CD leg |

Combining Technical Indicators

To enhance the effectiveness of AB=CD Technical Analysis, combining it with other indicators is wise. Tools like Moving Averages, RSI, and MACD can significantly boost signal reliability and predictive accuracy.

- Moving Averages: Assist in identifying trend directions and potential reversals.

- RSI (Relative Strength Index): Measures the speed and change of price movements, providing insights into overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): Helps in understanding the relationship between two moving averages, indicating potential buy or sell signals.

By integrating these indicators into the analysis, traders can develop a more comprehensive strategy. This approach ensures informed and timely trading decisions.

Executing the AB=CD Trading Strategy

In the execution phase of the AB-CD Trading Strategy, precision is paramount for identifying entry points. I focus on the CD leg’s completion at a key support or resistance level. This is where I place my trades and set initial stop-loss limits, managing potential risks effectively.

Setting appropriate profit targets is another critical aspect of the strategy. I use technical indicators like the Relative Strength Index (RSI) or Moving Averages to validate the AB=CD Pattern before trading. This step boosts the strategy’s effectiveness.

Trade management and adjustments based on market movements are vital. If the trade goes in my favour, I adjust my stop-loss to secure profits. If the market shifts against me, a defined stop loss limits losses. This disciplined approach helps me navigate market volatility confidently.

For those interested in deeper strategies, the 50% retracement play provides insights into identifying precise retracement opportunities. It aligns with the AB=CD Trading Strategy, offering a comprehensive trading approach in volatile markets.

Effectively executing the AB=CD Trading Strategy requires meticulous planning, strategic entry and exit points, and dynamic risk management. By combining robust technical analysis, traders can maximise returns while minimising risks, ensuring long-term success in Forex trading.

Common Mistakes in AB=CD Trading

AB=CD trading offers the potential for substantial profits, but it’s a journey filled with obstacles. Many traders face setbacks due to common errors. Let’s explore these typical mistakes and how to avoid them for better trading results.

Overlooking Pattern Symmetry

Traders often overlook the significance of pattern symmetry in AB=CD trading. The pattern’s success depends heavily on the symmetry between its legs. Neglecting this balance can lead to incorrect trading decisions. By focusing on symmetry, traders can receive clearer signals, increasing the chances of successful trades.

Misidentifying Patterns

Misidentifying patterns is another significant error in AB=CD trading. This mistake often stems from rushed analysis or a lack of understanding of the pattern’s features. Acquiring a solid grasp of AB=CD patterns and their impostors through education and practice can greatly reduce errors. Being cautious and patient in pattern identification is crucial for accurate and profitable trading.

By addressing these common mistakes, traders can enhance their skills in AB=CD trading. This improvement leads to greater profits and fewer losses.

Advanced Techniques for AB=CD Trading

Mastering Advanced AB-CD Trading Techniques can greatly improve your trading strategy. By delving deeper into analysis, you can boost the accuracy and effectiveness of your trades. Key aspects include integrating multiple time frames and using AB-CD Pattern Divergence for confirmation.

Integrating Multiple Time Frames

Trading with the AB=CD pattern requires looking beyond a single time frame. This approach allows you to understand market movements in context and validate patterns across different intervals. Here’s how integrating multiple time frames enhances your trading:

- Wider Market Perspective: Analyzing various time frames offers a broader view, revealing both micro and macro trends.

- Improved Pattern Confirmation: Verifying the AB=CD pattern across multiple time frames increases reliability and reduces false signal risk.

- Enhanced Entry and Exit Points: Combining higher time frames for trend direction with lower time frames for exact entries and exits refines your strategy for precision.

Using Divergence for Confirmation

Another valuable strategy is leveraging AB-CD Pattern Divergence. This technique involves comparing price action with indicators to spot potential reversals or continuation points:

- Relative Strength Index (RSI): RSI divergence highlights when price highs and lows don’t align with the indicator, signaling potential trend shifts.

- MACD (Moving Average Convergence Divergence): MACD divergence is a great tool for confirming AB=CD patterns, enhancing trade entry accuracy.

- Stochastic Oscillator: This indicator is useful for identifying divergence and potential overbought or oversold conditions that align with the AB=CD pattern outlook.

Real-Life Examples of AB=CD Trading Pattern

Exploring Real-Life AB-CD Trading instances provides deep insights into the AB=CD pattern’s functionality across different market scenarios. I’ve compiled several AB-CD Pattern Examples from real trading scenarios to highlight the pattern’s effectiveness.

Consider a Forex market scenario with the USD/EUR currency pair. I identified a key AB leg followed by a BC retracement. The subsequent CD leg perfectly completed the pattern, opening a high-probability trade opportunity.

In the stock market, Apple Inc.’s share prices showcased the AB=CD pattern. By spotting the symmetry in its ABCD formation, I forecasted price movements. This led to a strategic entry point, resulting in substantial returns.

Here are the specifics of these examples:

| Market | Instrument | AB Leg | BC Retracement | CD Completion | Outcome |

|---|---|---|---|---|---|

| Forex | USD/EUR | 1.1234 to 1.1345 | 1.1345 to 1.1280 | 1.1280 to 1.1390 | Profit |

| Stocks | Apple Inc. | $145 to $155 | $155 to $150 | $150 to $160 | Profit |

These Real-Life AB-CD Trading examples underscore the AB=CD pattern’s strength when applied accurately. Whether in Forex or stocks, identifying harmonic sequences in market movements aids in making informed trading decisions, as these AB-CD Pattern Examples illustrate.

Conclusion

In this AB=CD Trading Summary, we’ve delved deep into the AB=CD pattern. We’ve explored its core elements and historical development. This pattern is a crucial tool for traders aiming to enhance their strategies. It offers a detailed analytical framework, highlighting its value in both traditional and modern trading.

Each phase of the pattern—AB, BC, and CD—plays a vital role. They work together to provide insights into market movements. By using Fibonacci ratios and technical indicators, traders can refine their strategies. Real-life examples demonstrate the pattern’s practical application across different market conditions.

The AB=CD pattern underscores the importance of structured trading methods. As markets evolve, its timeless principles remain invaluable. By applying these principles, traders can better navigate the trading world. The AB=CD pattern will continue to play a significant role in the financial markets’ ever-changing landscape.